Sugar-free and keto-compatible functional beverages depend on sweetener systems that preserve ketosis and stabilize blood glucose. The global sugar-free drinks market reached $72.78 billion in 2024 and projects growth to $275.5 billion by 2033 at a 15.94% CAGR, driven by diabetes prevalence and low-carb diet adoption. Key sweeteners include erythritol (glycemic index 0), stevia (zero calories), monk fruit extract (200-300x sweeter than sugar), and allulose (mimics sugar texture without metabolic impact). Formulators must address pH stability, heat processing effects, and ingredient synergies while controlling costs—natural sweeteners cost 5-8x more than sugar. These formulations target consumers following ketogenic diets, managing blood sugar, or seeking functional nutrition without compromising taste or label transparency.

How Do Sugar-Free Sweeteners Maintain Stability in Functional Beverages?

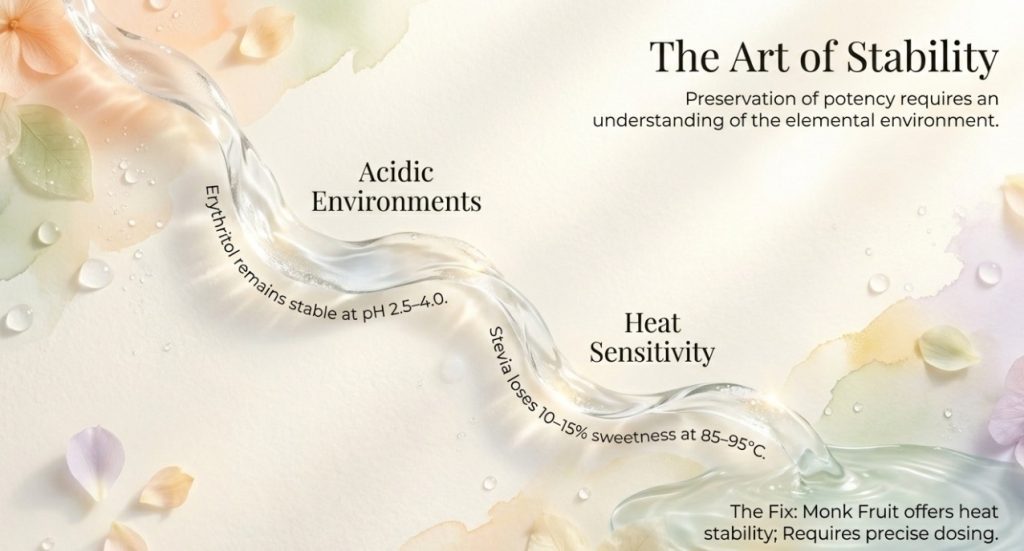

Sweetener stability in beverage formulations hinges on pH control, processing temperatures, and ingredient interactions. Erythritol remains stable in acidic environments (pH 2.5-4.0) without crystallization, making it suitable for ready-to-drink teas and carbonated drinks. Stevia can lose 10-15% sweetness intensity during high-temperature pasteurization (85-95°C), necessitating blends with erythritol to maintain consistent sweetness curves across production batches. Monk fruit extract demonstrates superior heat stability but requires careful dosing to avoid lingering bitterness—typical ratios combine monk fruit with other sweeteners at 1:3.

Allulose presents unique challenges in powder applications due to its hygroscopic nature. Formulators address this through anti-caking agents like silicon dioxide and recommend storage below 60% relative humidity. According to Cargill’s technical documentation, their EverSweet stevia paired with natural flavor modulators effectively masks off-notes from caffeine, vitamins, and minerals while enhancing fruit flavor profiles. The formulation process demands iterative testing to balance sweetness perception, mouthfeel, and cost constraints while meeting clean-label expectations.

Critical Factors for Keto-Friendly Functional Drink Development

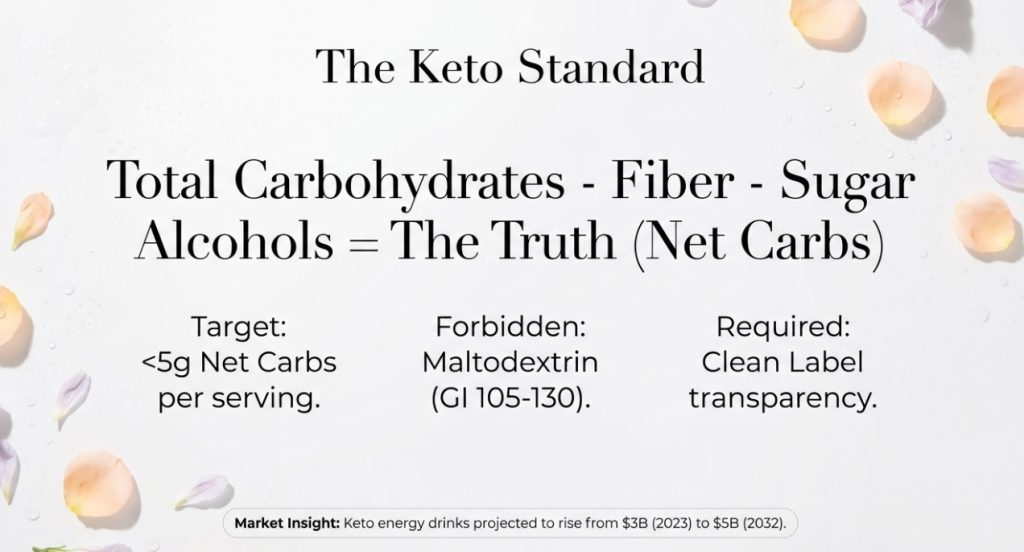

Ketogenic diets restrict daily carbohydrate intake below 50 grams, making net carbs (total carbs minus sugar alcohols and fiber) the primary evaluation metric for beverage formulations. Keto-compliant drinks maintain net carbs under 5 grams per serving while incorporating functional ingredients like medium-chain triglycerides (MCTs), collagen peptides, or branched-chain amino acids (BCAAs). Consumers demand transparent labeling that identifies hidden sugar sources, particularly maltodextrin (glycemic index 105-130), which manufacturers sometimes use as filler or flavor carrier.

Market data reveals keto-friendly energy drinks experienced the fastest growth within the sugar-free category, reaching $3 billion in 2023 with projections of $5 billion by 2032. These products combine zero-sugar formulations with cognitive enhancement compounds such as L-theanine, ginkgo biloba extract, and natural caffeine sources. The positioning appeals to fitness enthusiasts and professionals seeking sustained energy and mental focus without disrupting ketosis or triggering insulin spikes. Formulation success depends on delivering functional benefits through bioavailable ingredients while maintaining flavor profiles consumers associate with traditional energy drinks.

Taiwan’s Supply Chain Advantage for Sugar-Free Innovation

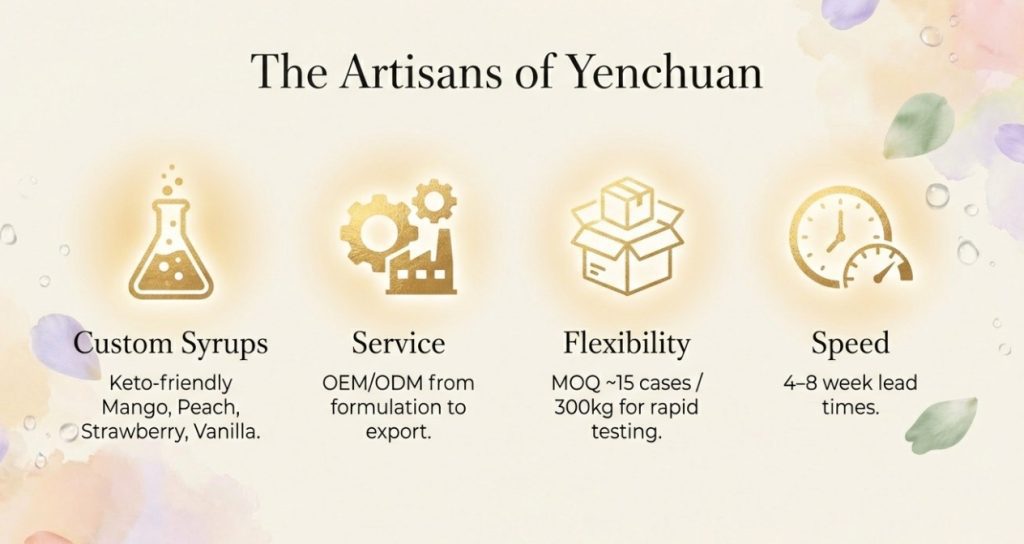

Taiwan’s bubble tea ingredient manufacturing ecosystem provides comprehensive support for sugar-free functional beverage development. Industry leaders like Yenchuan, Possmei, and Fuyou offer customization services for syrups, powders, and toppings with HACCP, ISO 22000, and HALAL certifications. These manufacturers operate dedicated R&D laboratories capable of adjusting sweetness profiles, texture characteristics, and functional additive ratios based on client specifications.

Yenchuan’s keto-friendly syrup range includes mango, orange, peach, strawberry, and vanilla flavors with zero sugar content and no glycemic impact, suitable for tea, coffee, and dessert applications. Combined with sugar-free coffee powder and various milk tea bases, brands can rapidly develop market-ready product lines. OEM/ODM services provide end-to-end support from formulation through packaging design and export logistics, compressing time-to-market for new product launches.

| Supplier Category | Core Strengths | Best Use Cases |

|---|---|---|

| Raw Material Manufacturers | Scale production, price competitiveness | Chain brands, bulk purchasing |

| Custom Formulators | Recipe flexibility, small-batch capability | Startups, market testing |

| Integrated Service Providers | Full supply chain, technical support | International expansion, rapid iteration |

Balancing Sweetness, Functionality, and Production Costs

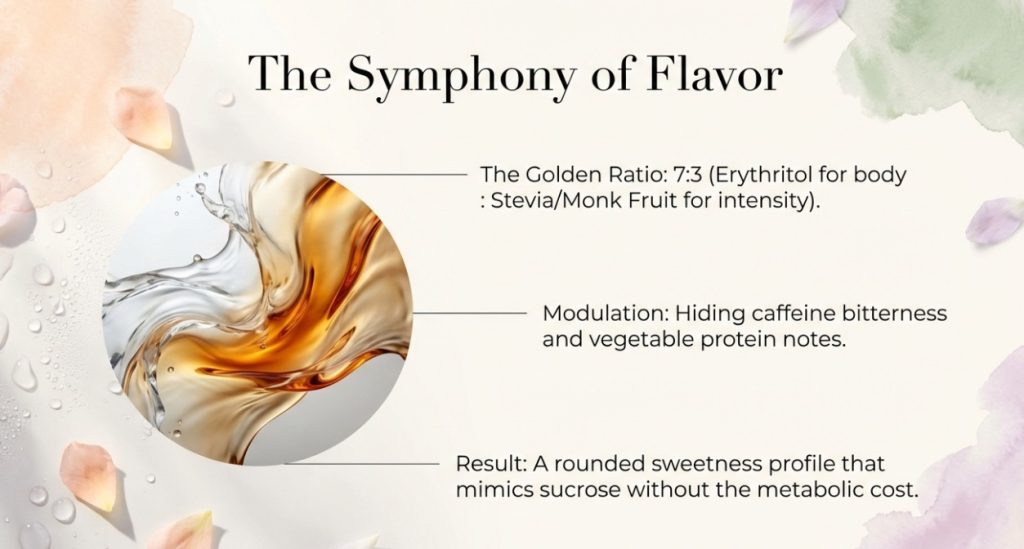

Functional beverage formulation complexity stems from simultaneously meeting sensory expectations, nutritional claims, and manufacturing feasibility. Natural sweeteners cost 5-8x more than sugar—stevia ranges $80-120 per kilogram while monk fruit extract reaches $150-200. Cost management strategies typically employ sweetener blending: erythritol provides bulk and mouthfeel while high-intensity sweeteners like stevia or monk fruit deliver sweetness, often at 7:3 ratios.

Functional ingredients including probiotics, adaptogens, and omega-3 fatty acids frequently present challenging flavor profiles requiring masking strategies. Virginia Dare’s technical team notes that addressing caffeine bitterness, plant protein off-notes, or mineral metallic tastes demands customized flavor enhancement and bitter-blocking systems tailored to specific product formats, target flavor profiles, and label requirements. One-size-fits-all solutions rarely succeed in this context.

Solubility and texture present additional hurdles. Adaptogens, minerals, and fibers can cause cloudiness, grittiness, or unwanted foaming. Solutions include ingredient pre-processing through microencapsulation, optimizing mixing sequences, precise pH control, or selecting stabilizers aligned with clean-label expectations such as xanthan gum or gellan gum. The formulation process requires technical expertise in ingredient chemistry and extensive bench testing before pilot production.

Market Evolution: Where Functionality Meets Sugar Reduction

Consumer expectations have evolved beyond basic sugar elimination toward beverages delivering additional health benefits. The 2024 functional beverage landscape emphasizes gut-health sodas, protein drinks, enhanced juices, and better-for-you energy products. These formulations integrate BCAAs, electrolyte systems, and plant-based energy sources (green tea extract, guayusa) targeting athletes, keto dieters, and individuals managing metabolic conditions.

SPINS data tracking 2023-2024 functional beverage innovation reveals explosive growth in specific flavor categories: herb and herbal flavors (+527.9%), cherry cola (+383.6%), cream soda (+378.3%), and lemonade (+337.3%). Brands capture experiential consumers through innovative flavor pairings (matcha-vanilla, lemongrass-turmeric) while maintaining sugar-free or low-sugar positioning. Product development increasingly incorporates nootropics, adaptogens, and bioactive compounds addressing cognitive performance, stress management, and recovery.

Asia-Pacific markets project the fastest growth through 2030 with an 8.73% CAGR. Urbanization and rising middle-class incomes drive demand for premium sugar-free products including confectionery, dairy alternatives, and organic plant-based beverages. Government sugar taxes in Thailand, Philippines, and other markets accelerate manufacturer reformulation efforts. North America maintains market leadership with a 32.36% share in 2024, supported by mature regulatory frameworks and insurance-subsidized nutrition counseling promoting sugar avoidance.

Certification and Regulatory Frameworks Ensuring Market Access

Sugar-free and keto-friendly beverages must comply with jurisdiction-specific labeling regulations. FDA standards permit “sugar-free” claims when products contain less than 0.5 grams sugar per serving, while “zero sugar” requires complete absence of digestible carbohydrates. European Union regulations require sugar content below 0.5 grams per 100 milliliters for sugar-free claims, with mandatory declaration of sweetener types and potential laxative effects from excessive sugar alcohol consumption.

“Keto-friendly” lacks regulatory definition, but brands must ensure net carbs remain below 5 grams per serving to avoid consumer deception claims. Third-party certifications like Keto Certified (issued by Paleo Foundation) enhance product credibility. Additional certifications—organic, non-GMO, clean-label—require investment in ingredient traceability and audit compliance but enable premium market positioning. Brands entering international markets must navigate varying approval processes for sweeteners, with some jurisdictions restricting specific sugar alcohols or requiring pre-market authorization.

Brand Success Strategies: From Formulation to Market Positioning

Zevia’s stevia-based zero-sugar soda expanded into Canadian and European markets in 2024, partnering with regional retailers and e-commerce platforms to reach health-conscious consumers. The brand employs erythritol and monk fruit blends to eliminate the bitter aftertaste plaguing earlier stevia formulations, offering cola, lemon, orange, and over 15 flavor variants. Strategic positioning emphasizes natural ingredients and zero calories without artificial sweeteners.

Virgil’s Zero Sugar line targets consumers seeking traditional soda flavor profiles without aspartame, using erythritol-monk fruit combinations that successfully replicate classic cola taste. Monster Zero Ultra and Bang Energy built loyalty among fitness and gaming demographics through extensive flavor portfolios (10+ variants) emphasizing zero sugar, zero calories, and cognitive enhancement ingredients (taurine, caffeine). Product innovation focuses on sustained energy delivery without sugar crashes.

Pure Leaf’s collaboration with PepsiCo launching zero-sugar sweet tea demonstrates that even highly competitive categories offer opportunities through clear health positioning and flavor execution. The brand capitalized on growing demand for ready-to-drink tea alternatives to sugary beverages, proving that transparent ingredient lists and taste quality can create market differentiation in saturated segments.

Authoritative Sources

- Future Market Insights – Zero Sugar Beverages Market Report

- Mordor Intelligence – Sugar-Free Food and Beverage Market Analysis

- BevSource – Better-for-You Beverage Development

- Beverage Industry – Sweeteners Support Beverage Innovations

- U.S. News – Keto-Friendly Sweeteners Guide

Frequently Asked Questions

Ready-to-drink beverages using erythritol and stevia achieve 12-18 months ambient shelf life following HTST pasteurization. Powder formats with appropriate anti-caking agents and oxygen-barrier packaging extend to 24 months. Critical factors include controlling water activity below 0.6, avoiding light exposure and heat storage. Products containing probiotics require refrigeration to maintain strain viability and should display shorter dating.

Net carbs equal total carbohydrates minus sugar alcohols and dietary fiber. A beverage containing 10g total carbs, 5g erythritol, and 2g fiber yields 3g net carbs, meeting keto standards. Note that maltodextrin—though labeled as carbohydrate—significantly impacts blood glucose and should be avoided. Regulatory calculation methods for sugar alcohol and fiber subtraction vary by jurisdiction.

Taiwan beverage ingredient manufacturers offer formulation development, flavor adjustment, packaging design, and small-batch trial production. Yenchuan and similar suppliers support OEM/ODM with typical minimum orders of 15 cases (approximately 300kg), assisting with target market certifications including HACCP, ISO 22000, and HALAL. Lead times range 4-8 weeks depending on complexity.

Common failures stem from imbalanced formulations producing bitter aftertastes, metallic notes, or chemical sensations due to insufficient sensory testing rounds. Excessive cost control selecting inferior sweeteners compromises taste. Overlooking pH and temperature effects on sweetness perception causes stability issues. Unclear market positioning or packaging failing to communicate health benefits prevents target audience engagement.

Application-specific recommendations: carbonated drinks use erythritol-stevia blends (7:3) balancing bulk and sweetness; hot beverages benefit from monk fruit-allulose combinations offering heat stability and sugar-like mouthfeel; powder formats employ stevia-inulin for cost efficiency and solubility. Conduct sensory testing confirming target consumer acceptance while evaluating cost structures and label-friendly positioning.

Author: Michael Zhang

As a food technology consultant and formulation specialist, I’ve witnessed sugar-free functional beverages evolve from niche health products into mainstream consumer staples. Today’s consumers refuse to compromise between health and taste—they demand products delivering flavor, function, and label transparency simultaneously. Taiwan’s supply chain offers international brands unique advantages: technical expertise combined with flexible service models enabling rapid prototyping and scaled production. Success requires more than selecting appropriate sweeteners; it demands understanding target consumers’ taste preferences, usage contexts, and values, then iteratively optimizing formulations that genuinely meet those needs.

Ready to explore sugar-free and keto-friendly beverage formulation for your brand? Schedule a consultation with Yenchuan’s team to discuss ingredient solutions tailored to your market.