“We evaluate about 200 potential suppliers every year,” the VP of Procurement for a national foodservice distributor told me last month. “Maybe 15 make it through our vetting process. The difference between those who make the cut and those who don’t? It’s rarely about price anymore.”

That conversation came back to me as I’ve spent the past few weeks talking with procurement executives, distribution directors, and supply chain strategists across the beverage and foodservice space. What struck me most wasn’t the complexity of their evaluation criteria—though that’s considerable—but how much the priorities have shifted in just the past two years.

If you’re a supplier hoping to land distribution partnerships, or you’re already in the game and wondering why some relationships thrive while others stagnate, understanding what distributors actually care about has become essential. The rules have changed, and the stakes are higher than ever.

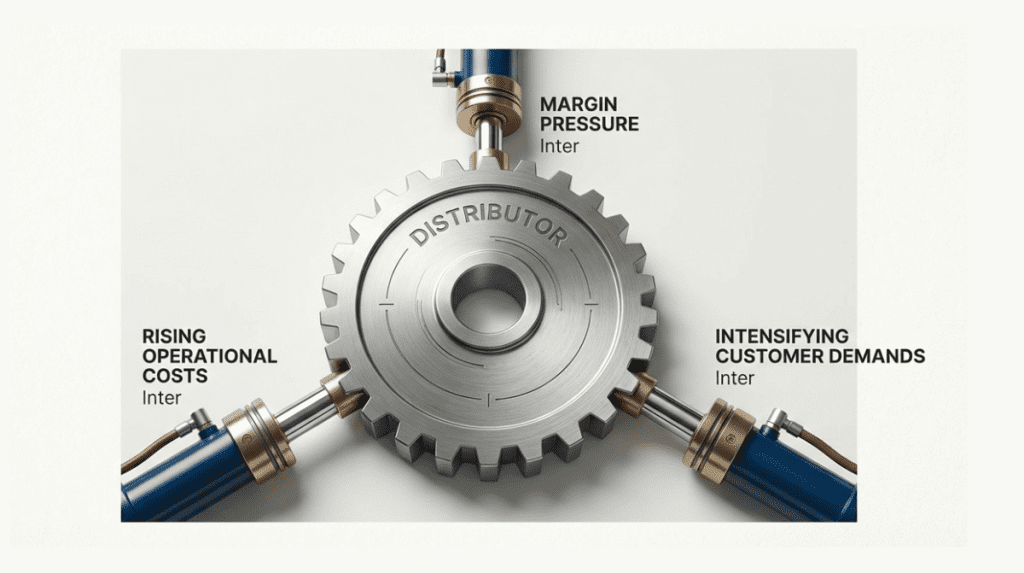

The New Economics of Distribution Partnerships

Let’s start with the uncomfortable truth: distributors are under pressure from every angle. Their margins have compressed as operational costs—labor, fuel, warehousing—have climbed. Their customers demand more SKUs, faster delivery, and better pricing simultaneously. And their investors or ownership groups expect profitable growth even as competition intensifies.

In this environment, every supplier relationship gets scrutinized through a lens that goes well beyond unit economics. David Martinez, Regional Director for a mid-Atlantic beverage distributor, put it bluntly: “We can’t afford partnerships that drain operational bandwidth. If a supplier creates friction—inconsistent quality, poor communication, delivery failures—they’re costing us money even if their prices look good on paper.”

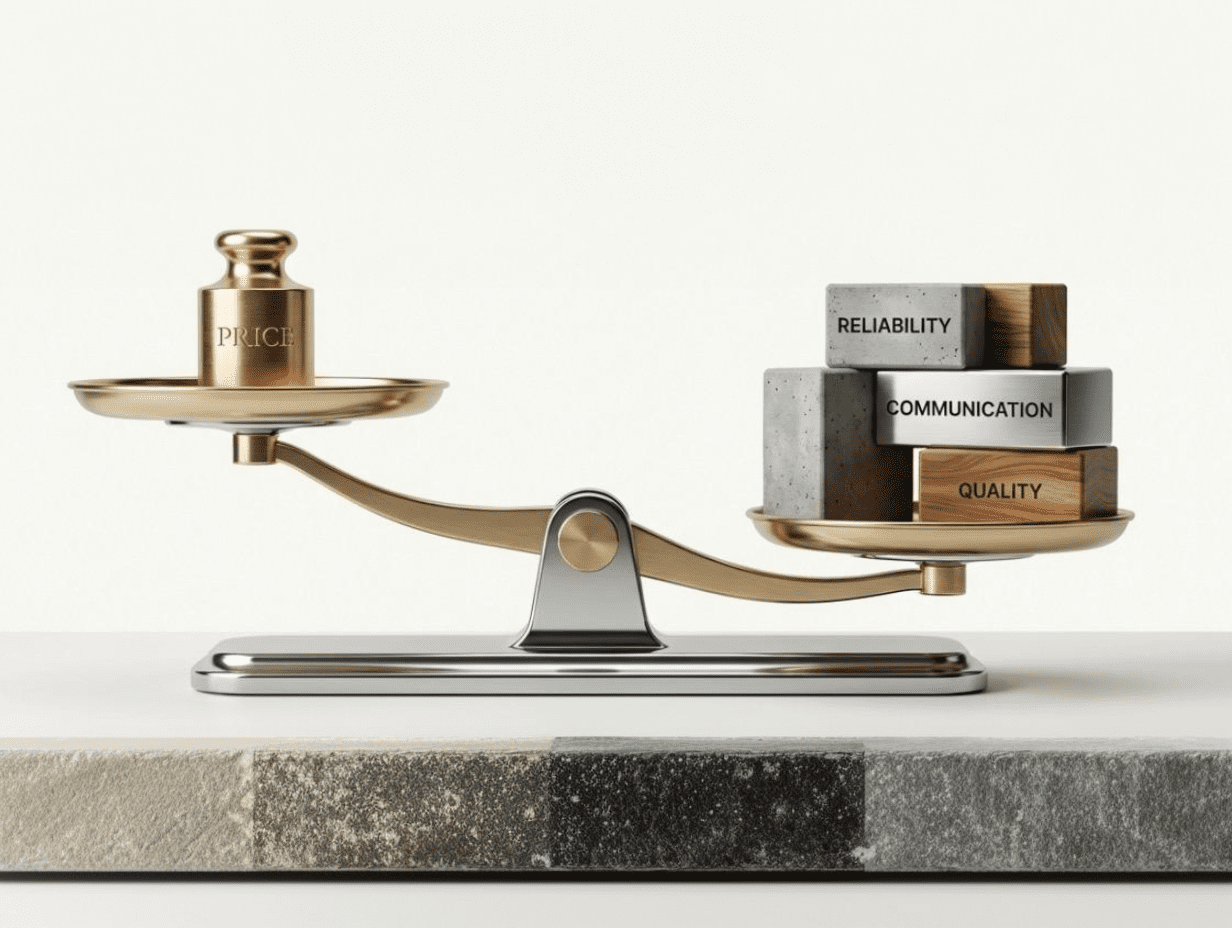

This shift explains why procurement scorecards now weight operational reliability as heavily as, or more than, price competitiveness. Distributors have learned the hard way that a supplier who comes in 8% cheaper but misses 15% of delivery windows ends up costing them far more in expedited freight, customer service issues, and account retention problems.

Financial Stability: The Non-Negotiable Foundation

Before distributors dive into product quality or service capabilities, they’re running financial health checks. Multiple procurement executives told me they’ve walked away from attractive supplier opportunities because red flags appeared in financial due diligence.

What are they looking for? Credit ratings from Dun & Bradstreet or similar agencies. Banking references. Years in business. Ownership stability. For smaller suppliers without extensive financial disclosure, distributors want to see consistent growth, reasonable debt ratios, and cash flow that suggests the business can weather disruptions.

“We had a bubble tea ingredient supplier approach us with fantastic products and pricing,” one director shared. “But they’d been in business for 18 months, had changed ownership twice, and couldn’t provide audited financials. That’s a risk we can’t take when we’re building three-year customer contracts around their products.”

The lesson for suppliers? Financial transparency isn’t negotiable anymore. Distributors need confidence that you’ll be in business tomorrow, next quarter, and three years from now. Professional manufacturing services that demonstrate longevity and stability provide this assurance.

Product Quality and Consistency: Beyond the Sample

Every supplier sends great samples. What separates serious contenders from pretenders is consistency over time—and having the systems to prove it.

Sarah Chen, Quality Director for a West Coast distributor, walked me through what she calls “consistency verification.” When evaluating new suppliers, her team requires: batch-to-batch specifications over a six-month period, third-party quality certifications, documented quality control procedures, and references from existing customers who’ve been buying for at least two years.

“We test samples, obviously,” Chen explained. “But we also request samples from three different production runs, sometimes months apart. Are they identical? Or do we see variation that suggests quality control issues?”

For bubble tea suppliers specifically, this means demonstrating consistency in critical attributes—tapioca pearl texture after specified cooking times, syrup viscosity at different temperatures, powder solubility under various conditions. Customization capabilities matter, but not if they come at the expense of batch-to-batch reliability.

Certifications carry weight here. FSSC 22000, BRC, HACCP, organic certifications, kosher or halal compliance—these aren’t just nice-to-haves. They’re table stakes for serious distribution relationships. Multiple distributors told me they’ve accelerated supplier approvals by six months simply because proper certifications eliminated lengthy quality verification processes.

Supply Chain Resilience and Scalability

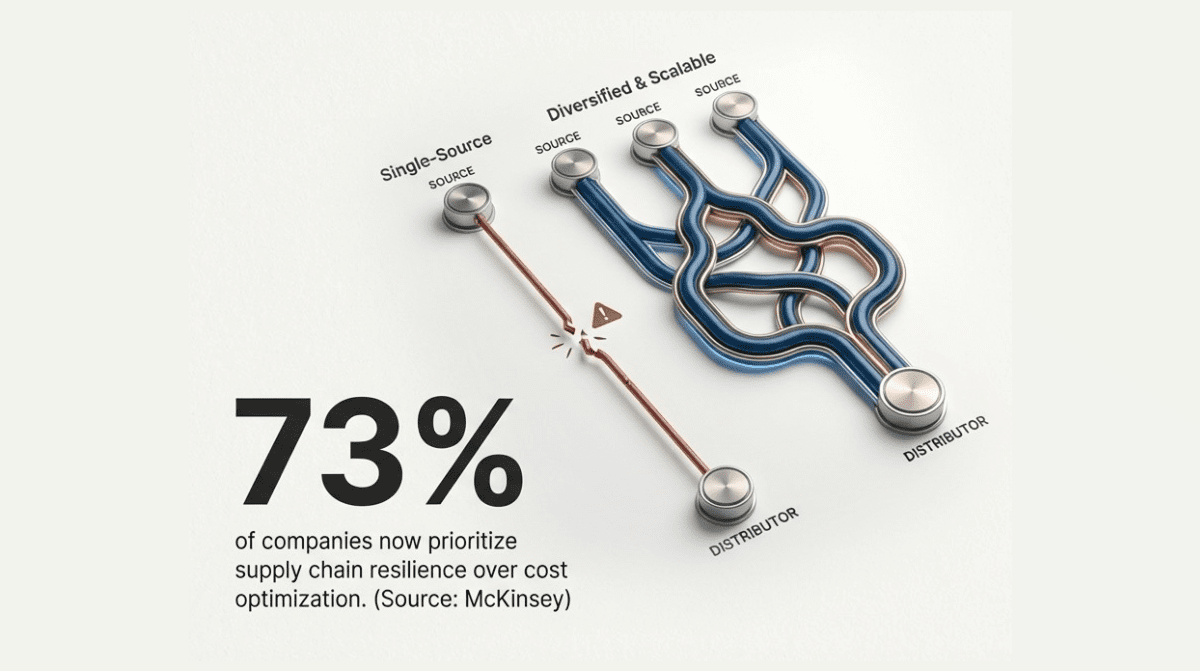

The pandemic permanently changed how distributors evaluate supplier risk. Questions about supply chain resilience now come early in every conversation, and the answers matter enormously.

What do distributors want to know? Raw material sourcing strategies—single source or diversified? Geographic concentration risks? Inventory policies? Lead time flexibility? Capacity headroom for growth?

“We need suppliers who can scale with us,” explained Michael Torres, Director of Supply Chain for a Southeast regional distributor. “If we’re going to invest in building market presence for their products—sales training, marketing support, inventory risk—we need confidence they can support 50% year-over-year growth for three consecutive years without breaking.”

This requirement often surprises smaller suppliers. You might be perfectly executing on current demand, but can you triple production if three major accounts come through simultaneously? Do you have contingency suppliers for critical raw materials? Can you shift production between facilities if one goes down?

Research from McKinsey indicates that 73% of companies now prioritize supply chain resilience over cost optimization—a dramatic reversal from pre-2020 priorities. For supplier evaluation, this translates to preference for partners with diversified sourcing, excess capacity, and documented business continuity plans.

Communication and Responsiveness: The Operational Reality

Here’s something that rarely appears on formal scorecards but came up in nearly every conversation: responsiveness. How quickly does your team answer questions? Can customers reach real humans who can solve problems? Do you proactively communicate about potential issues?

“We had a supplier whose products were excellent and pricing was competitive,” one procurement director shared. “But getting answers to basic questions took days. If a customer had an issue, we couldn’t get resolution quickly. After six months, we switched to a slightly more expensive supplier whose team responds in hours, not days.”

In practical terms, distributors evaluate communication capabilities across several dimensions: Account management accessibility and knowledge, customer service response times and resolution rates, technical support for product applications, and proactive communication about supply issues or changes.

The bar here has risen dramatically. Distributors expect supplier partners to operate like extensions of their own team. That means understanding their business, knowing their customer base, and bringing solutions rather than just taking orders.

Pricing and Payment Terms: It’s Complicated

Price matters, but not how you might think. Every distributor I spoke with emphasized that they’re not chasing the absolute lowest price—they’re seeking the best value equation.

That equation includes: Product cost relative to quality and performance, payment terms and credit flexibility, volume incentives and rebate structures, freight policies and inbound logistics, and co-marketing support and promotional allowances.

“We’ve chosen more expensive suppliers multiple times when the total value proposition was better,” explained one VP of Procurement. “Maybe they offer better payment terms. Or they provide marketing support that helps us sell through faster. Or their freight policies reduce our inbound costs. Price is one input, not the only input.”

For suppliers, this creates opportunities to compete on value rather than just on price. Can you offer extended payment terms to distributors with strong credit? Can you provide shelf-talkers, recipe cards, or training materials that help their sales teams sell your products? Can you manage VMI (vendor-managed inventory) to reduce their carrying costs?

Cornell University research on food supply chain economics shows that distributors achieve 23% better margins with suppliers who offer comprehensive value beyond just product—through marketing support, technical training, and operational collaboration.

Innovation and Product Development Partnership

Forward-thinking distributors aren’t just looking for suppliers who can fulfill today’s orders. They want partners who can help them anticipate and capture tomorrow’s opportunities.

What does this look like in practice? Suppliers who bring emerging trend insights, collaborate on new product development, customize formulations for specific market needs, and respond quickly to innovation requests get preferred status.

Jennifer Park, Innovation Director for a national distributor, described her ideal supplier relationship: “We want partners who understand where the market is heading and can help us get there first. If we see an emerging trend—say, functional bubble tea with wellness benefits—can our supplier create custom formulations quickly? Will they invest in R&D alongside us?”

This innovation partnership extends beyond just product development. It includes sharing market intelligence, collaborating on packaging innovations, supporting new channel opportunities, and co-developing sustainability initiatives. Distributors increasingly view their supplier relationships as strategic partnerships rather than transactional arrangements.

Sustainability and Social Responsibility

Environmental and social governance (ESG) factors have moved from “nice to have” to “must have” in supplier evaluation—especially for distributors serving institutional customers or retail chains with public sustainability commitments.

Procurement teams now regularly request: Carbon footprint data and reduction plans, sustainable sourcing certifications, waste reduction and recycling initiatives, water usage and conservation practices, and labor practices and workplace safety records.

“Our largest customers require ESG reporting,” one distributor explained. “We can’t partner with suppliers who can’t provide this data. It’s not optional anymore—it’s part of doing business.”

For bubble tea ingredient suppliers, this might mean demonstrating sustainable sourcing for tapioca, recyclable or compostable packaging options, energy-efficient production processes, and transparent labor practices throughout the supply chain. Industry insights and tips on sustainability are becoming crucial differentiators.

The Due Diligence Process: What to Expect

Understanding evaluation criteria is one thing—knowing the actual process helps suppliers prepare effectively. Here’s the typical timeline and sequence:

Phase 1: Initial Screening (Weeks 1-2) includes basic information request, financial review, preliminary pricing discussion, and reference checks.

Phase 2: Product Evaluation (Weeks 3-6) involves sample testing, quality documentation review, manufacturing facility audit (often virtual initially), and consistency verification across multiple batches.

Phase 3: Operational Assessment (Weeks 7-10) includes supply chain due diligence, capacity analysis, systems integration testing, and customer service evaluation.

Phase 4: Business Terms Negotiation (Weeks 11-14) covers pricing and payment terms, volume commitments and incentives, service level agreements, and marketing and promotional support.

Phase 5: Pilot Launch (Months 4-6) includes limited geographic or customer rollout, performance monitoring against KPIs, and issue identification and resolution.

The entire process typically runs 4-6 months from first contact to full distribution partnership. Suppliers who can accelerate this by having documentation ready, offering transparent facility access, and demonstrating operational sophistication gain competitive advantage.

What This Means for Suppliers

If you’re pursuing distribution partnerships or looking to strengthen existing relationships, the message is clear: operational excellence matters as much as product quality. Price competitiveness is necessary but not sufficient. And strategic partnership capabilities increasingly determine who wins.

The suppliers thriving in today’s distribution landscape share common characteristics. They treat distributors as true partners, investing in relationship-building and mutual success. They maintain rigorous operational standards that make them easy to do business with. They bring innovation and market insights that create competitive advantages. And they demonstrate financial stability and supply chain resilience that reduce distributor risk.

For professional bubble tea suppliers, this means evolving beyond transactional supplier relationships toward strategic partnerships that create value across multiple dimensions—product quality, operational reliability, innovation capability, and market insight.

The bar for distribution partnerships has risen significantly. But for suppliers willing to invest in capabilities that distributors genuinely value, the opportunity to build lasting, profitable relationships has never been greater.

FAQ

Distributors require suppliers to hold FSSC 22000, BRC, and HACCP food safety certifications, plus organic, kosher, or halal compliance where applicable. These certifications can accelerate supplier approval by six months and are table stakes for serious distribution relationships, demonstrating quality control capabilities while reducing distributor verification costs and risk exposure.

Distributors check Dun & Bradstreet ratings, banking references, years in business, and ownership stability. For smaller suppliers without extensive disclosure, distributors want consistent growth records, reasonable debt ratios, and cash flow evidence. Financial transparency is non-negotiable—distributors need confidence suppliers will remain operational for three-year customer contracts.

From first contact to full partnership takes 4-6 months typically. The process includes initial screening, quality verification (multi-batch testing), operational assessment (capacity analysis, systems integration), commercial negotiation, and pilot rollout in limited geography. Suppliers with ready documentation and transparent operations can accelerate this significantly.

73% of companies now prioritize supply chain resilience over cost optimization. Distributors evaluate raw material sourcing strategies, geographic risk concentration, inventory policies, lead time flexibility, and capacity headroom. Suppliers must demonstrate ability to support 50% year-over-year growth for three years with documented business continuity plans.

Distributors evaluate total value equation: product cost relative to quality, payment terms and credit flexibility, volume incentives and rebates, freight policies, and co-marketing support. Research shows suppliers offering comprehensive value beyond product—through marketing support, technical training, operational collaboration—achieve 23% better margins for distributors.

Sources & References

- McKinsey & Company – Supply Chain Operations — Supply chain resilience research

- Cornell Food Science Department — Food supply chain economics and margin analysis

- Dun & Bradstreet — Business credit and financial risk assessment standards

- Deloitte Food & Beverage — Distribution industry trends and procurement insights

About the Author

Robert Zhang is a Senior Business Development Strategist at YenChuan, specializing in B2B distribution partnerships and supply chain operations. With 15 years of experience working with foodservice distributors across North America and Asia, he brings deep insights into what makes supplier-distributor relationships successful. Robert believes the future belongs to suppliers who view their distributor partners as extensions of their own go-to-market strategy—investing in their success as vigorously as they invest in their own operations.

Connect with Robert on LinkedIn.

Ready to Become a Distributor-Preferred Supplier?

Whether you’re pursuing your first distribution partnership or looking to strengthen existing relationships, having the operational excellence and partnership capabilities that distributors value makes all the difference. YenChuan has been a trusted partner to distributors worldwide since 1988—delivering the consistency, quality, innovation, and reliability that create lasting distribution relationships.

Our team understands what distributors need: transparent operations, consistent quality, scalable capacity, and responsive partnership. From facility certifications to customized product development, we’re structured to meet the rigorous standards that top-tier distributors require.

Let’s discuss how we can support your distribution growth strategy. Book a consultation with our team →