Strategic B2B partnerships create value that transactional relationships cannot match. Research from Harvard Business Review reveals that 81% of procurement decision-makers must establish trust before finalizing contracts, while Bain & Company data shows a 5% improvement in customer retention can boost profits by 25-95%. The transition from supplier to strategic partner requires deliberate action: implementing quarterly business reviews, establishing joint goal frameworks, investing in co-innovation initiatives, and measuring value creation through performance scorecards. This model suits organizations willing to commit long-term resources and prioritize relationship capital over pure price competition.

Transitioning from Vendor to Strategic Partner: A Framework

The supplier-to-partner evolution follows a four-stage progression. Stage one establishes foundational trust through consistent delivery and meeting baseline performance metrics. Suppliers must demonstrate reliability in quality, on-time delivery, and responsive communication. Stage two showcases domain expertise by proactively sharing market intelligence, technical insights, and industry best practices that help clients navigate challenges. Stage three involves joint planning where both parties co-develop annual objectives, align on key performance indicators, and establish shared responsibility for outcomes. Stage four achieves value co-creation through dedicated R&D investments, joint product development, and integrated operational processes.

Oracle’s approach with global banking clients exemplifies this model. Rather than simply licensing software, Oracle embeds dedicated account teams who develop deep expertise in each client’s IT infrastructure. When core banking systems require upgrades or expansions, Oracle representatives already understand the technical landscape, regulatory requirements, and business objectives. This positioning transforms Oracle from a software vendor into an integral technology partner whose success depends on client outcomes. General Electric’s Power division similarly evolved beyond selling turbines to offering 20-year service agreements with on-site engineers who optimize entire plant operations.

How Do You Quantify Trust in Business Relationships?

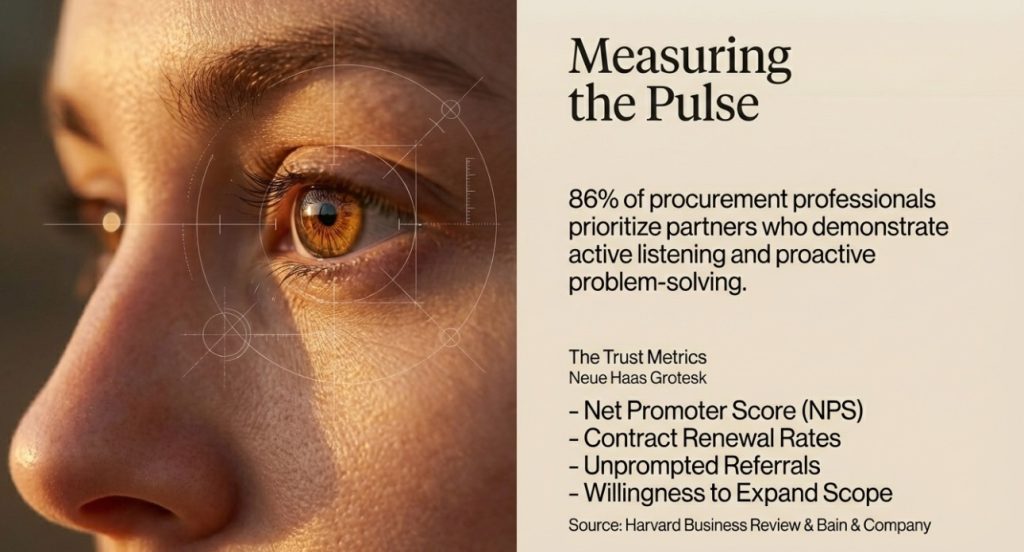

Trust represents more than goodwill; it functions as measurable business capital that compounds over time. Harvard Business Review research indicates that 86% of B2B procurement professionals place higher trust in partners who demonstrate active listening and take proactive approaches to problem-solving. Quantifying trust requires tracking specific behavioral indicators: transparency in sharing production forecasts and capacity constraints, responsiveness measured by issue resolution timeframes, consistency evaluated through delivery performance variance, and reliability demonstrated by contingency planning during market disruptions.

Specific metrics for trust measurement include Net Promoter Score among client stakeholders, contract renewal rates, unprompted referral generation frequency, and the client’s willingness to expand scope or increase wallet share. Bain & Company research demonstrates that customer retention improvements of just 5% correlate with profit increases between 25% and 95%, highlighting trust’s direct financial impact. GE Power’s service model illustrates trust operationalized: on-site engineers don’t merely maintain equipment but actively optimize operational output, creating shared incentives where GE’s success aligns with client productivity. This interdependence builds trust through aligned interests rather than contractual obligations.

Performance Evaluation: Moving Beyond Operational Metrics

Traditional supplier scorecards emphasize operational excellence: on-time delivery rates, defect levels measured in parts per million, cost savings achieved, and compliance with specifications. These remain essential for baseline performance management. Strategic partnerships require additional value-oriented metrics that assess future potential rather than past performance. Gartner recommends that strategic suppliers be evaluated on category strategy alignment, business partnership quality, supply chain resilience contribution, innovation capability, new product introduction support speed, and sustainability goal achievement progress.

McKinsey research shows high-performing procurement organizations systematically measure supplier performance and act on those insights as part of broader digital transformation initiatives. Practical implementation involves monthly operational KPI reviews combined with quarterly strategic performance discussions. The evaluation framework should incorporate supplier feedback on changes the buying organization needs to make, recognizing that mutual improvement drives overall value creation. Microsoft’s enterprise teams deploy customer success managers and technical account managers who co-own client goals, shifting evaluation focus from unilateral supplier assessment to collaborative outcome achievement.

Joint Value Creation: Practical Mechanisms and Examples

Value co-creation extends beyond cost reduction to encompass innovation, efficiency gains, and market opportunity development. Three core mechanisms enable this collaboration. First, joint innovation labs where both parties invest R&D resources to develop next-generation solutions that neither could create independently. Second, collaborative business planning that integrates demand forecasting, capacity planning, and inventory strategy to optimize supply chain performance. Third, shared performance incentive structures that tie rewards to specific outcome metrics rather than transactional volumes.

A food company partnering with packaging suppliers to develop recyclable containers demonstrates practical value co-creation. Both parties jointly test materials, track recyclability rates, and refine environmental performance while maintaining product protection standards. This collaboration requires transparent data sharing, regular technical reviews, and willingness to iterate based on field results. Coupa platform data reveals significant capital release potential: buyers can unlock over $353 billion trapped in excess inventory while suppliers reduce $223 billion in delayed receivables through optimized order processing and accelerated payment terms.

What Role Do Digital Tools Play in Partnership Management?

Modern supplier relationship management requires capabilities beyond spreadsheet tracking. Digital SRM platforms provide real-time visibility, cost reduction, and streamlined supplier lifecycle management. Core platform functions include deal registration systems that simplify sales tracking, training programs that equip partners with product knowledge, market development funds that support joint marketing efforts, configure-price-quote tools that streamline partner quoting processes, and incentive mechanisms that motivate sales performance.

Real-time monitoring tools enable proactive issue management by tracking key performance indicators as they occur. Metrics such as on-time delivery and quality fulfillment can be measured continuously rather than through periodic reviews. Platforms like ProQsmart streamline supplier performance reviews, minimize non-compliance risk with contract terms, and promote transparency. Effective collaboration tools including instant messaging channels, project management software, and shared document platforms facilitate coordination across teams and supplier networks. AWS offers enterprise clients 15-minute response SLAs for critical issues alongside technical account managers who co-own performance outcomes, exemplifying how technology enables high-touch service at scale.

Integrating Sustainability into Partnership Strategy

Sustainability has evolved from compliance requirement to strategic differentiator in B2B partnerships. Strategic supplier relationships advance sustainability objectives through three primary channels. First, reducing carbon emissions across the entire value chain by optimizing logistics, improving energy efficiency, and transitioning to renewable energy sources. Second, developing more environmentally friendly materials and manufacturing processes through joint R&D investments. Third, ensuring ethical labor practices throughout the supply network via transparent auditing and continuous improvement programs.

Siemens demonstrates sustainability through partnership by providing predictive maintenance via digital twin and IoT monitoring systems. Rather than waiting for equipment failures, Siemens alerts clients to potential issues in advance, preventing unplanned downtime and reducing resource waste. Circular economy practices benefit from strong supplier partnerships by keeping materials in use longer through reuse, remanufacturing, or recycling. Implementing these approaches requires coordination across multiple supply chain partners. Emirates NBD built its supplier relationships on three pillars: transparency, trust, and shared value. Evaluation criteria weigh service quality, risk profile, innovation potential, and ESG alignment alongside cost considerations.

Maintaining Long-Term Relationships: Key Practices

Partnership maintenance demands continuous investment and careful planning from all parties. Effective partnerships begin with clear, coordinated strategy. Partners need mutual understanding of expectations, established procedures for exchanging regular feedback, and agreed benchmarks for measuring progress toward goals. Communication and transparency rank as paramount priorities. Regular business review meetings maintain alignment and address issues before they escalate, typically conducted quarterly or biannually depending on relationship significance. These meetings provide forums to discuss performance, upcoming needs, and improvement opportunities.

Transparency means sharing relevant information that helps both companies succeed: production forecasts to help suppliers plan capacity, quality data to identify and address recurring issues, sustainability metrics to track progress toward shared goals, and market intelligence that informs strategic decisions. Challenge management tests partnership resilience. Rather than allowing obstacles to strain relationships, strategic partners view difficulties as opportunities to demonstrate reliability. Address issues directly, collaborate on solutions, and emerge from challenges with strengthened bonds. Harvard Business Review research finds that 60% of business relationships dissolve due to trust breakdown, often because companies fail to adapt to changing circumstances or neglect relationship nurturing.

From Product Supply to Solution Partnership

The most successful supplier partnerships shift focus from product features to customer outcomes. ASML lithography machines cost upwards of $100 million, yet chipmakers like TSMC and Intel pay this premium because the machines’ precision enables next-generation chip production, delivering unbeatable performance advantages. Caterpillar mining trucks operate in extreme conditions with minimal downtime, and mining operators value this reliability because delays cost millions. Cat’s premium pricing justifies through lower cost-per-ton over equipment lifetime. This outcomes-focused thinking elevates suppliers from parts providers to performance guarantors.

Solution partnership requires deep understanding of client business models, industry challenges, and competitive positioning. This demands investment in industry expertise, allocation of dedicated client teams, and development of industry-specific solutions. Customization services enable suppliers to create unique value propositions that commodity competitors cannot easily replicate. Cisco networking hardware powers banking systems, hospitals, and data centers worldwide. Its reputation for always-on resilience explains why many IT leaders choose Cisco despite cheaper alternatives. The premium justifies through operational risk reduction and business continuity assurance rather than component specifications alone.

Sources

- Gartner – Supplier Relationship Management: A Complete Guide

- Harvard Business Review – 3 Ways to Build Trust with Your Suppliers

- McKinsey & Company – Procurement Performance Management Research

- Eglobalis – Strategic Value Creation in B2B Partnerships

Frequently Asked Questions

B2B partnerships build on collaboration, shared goals, and long-term engagement that transcends transactional buyer-seller interactions. Traditional relationships emphasize cost, speed, or availability, while partnerships involve joint planning, performance improvement, and risk management. Both parties invest resources and receive benefits by working toward common objectives like reducing lead times or improving quality. Strategic alignment and mutual value creation differentiate true partnerships from commodity supply arrangements.

Trust takes years to earn and seconds to lose in B2B environments. Harvard Business Review research shows 81% of buyers need trust in a company before purchasing. Practically, establishing foundational trust through consistent delivery requires 6-12 months, while developing deep strategic partnership trust typically needs 2-3 years of sustained interaction. The key lies in demonstrating reliability, transparency, and commitment through every interaction, with trust compounding over time through repeated positive experiences.

Success metrics include both operational and strategic dimensions. Operational indicators: on-time delivery rates ≥ 98%, defect rates ≤ 250 PPM, cost savings targets. Strategic indicators: contract renewal rates, joint innovation project count, customer lifetime value growth, referral business percentage, issue resolution speed. McKinsey recommends monthly operational KPI reviews combined with quarterly strategic KPI assessments to balance tactical performance with long-term value creation.

Small businesses should focus on differentiated value rather than price competition. Key strategies include demonstrating deep domain expertise, offering flexible customization capabilities, establishing rapid response mechanisms, and investing in dedicated teams for key accounts. Research shows enterprise clients select small suppliers based on unique capabilities, positive reputation, and service quality. Confidently present your value proposition and stand your ground, remembering the client chose you for specific reasons.

Digitalization shifted from option to necessity in supplier relationship management. Spreadsheets cannot provide the real-time visibility, risk alerts, and performance tracking that scale demands. Modern SRM platforms offer deal registration, training management, market development funds, CPQ tools, and incentive automation. Coupa research shows companies adopting digital platforms unlock billions in trapped capital, improve cash flow metrics, and strengthen supply chain resilience through enhanced collaboration and transparency.

Author: Michael Zhang

Having spent 15 years working in food supply chains, I’ve observed too many companies trapped in destructive price competition cycles. Sustainable competitive advantage emerges from deep partnerships: when clients view you as an indispensable strategic resource, price becomes one variable among many rather than the sole consideration. This requires long-term investment, but the returns manifest as predictable revenue streams, lower customer acquisition costs, and resilience against market shocks. I recommend starting with one key client to pilot the strategic partnership model, using 12-18 months to validate value creation logic before expanding to other accounts.

Ready to explore how to upgrade your supplier relationships into strategic partnerships? Schedule a consultation with Yenchuan’s team to discuss solutions tailored to your business needs.