Consumer feedback loops systematically collect and analyze customer taste experiences to refine product formulations through continuous improvement. Research from Cornell University’s Food Science Department shows that beverages optimized through structured feedback systems achieve 40% higher market acceptance and 35% improved repurchase rates. This approach works best for food service operators with stable supply chains, investment capacity in data analytics, and customer bases large enough to generate statistically significant insights. For bubble tea manufacturers, consumer feedback directly influences syrup formulation ratios, tapioca pearl texture specifications, and powder flavor intensity.

Why Consumer Data Outperforms Internal Testing

Traditional food development relies on small expert panels, but this approach carries inherent biases. The UC Davis Sensory Science Center notes that trained panelists can detect subtle chemical differences yet often fail to predict mass market preferences. Real consumption includes variables like temperature, context, and personal dietary habits that laboratories struggle to replicate. Consumer feedback loops integrate data from actual consumption environments, capturing taste preference distributions across demographic segments.

Large-scale data collection reveals expert blind spots. A fruit syrup might score excellently in lab conditions yet disappoint consumers because its aroma volatilizes too quickly in hot weather. Data-driven methods transform subjective evaluations into quantifiable metrics, providing objective foundations for formula adjustments. The shift from expert opinion to consumer evidence changes how manufacturers approach flavor development.

Three Core Methods for Sensory Data Collection

Discrimination testing uses triangle tests or paired comparisons to determine whether consumers detect formula changes. When manufacturers adjust milk fat content in milk tea powder or the chewiness of pearls, discrimination testing quantifies the perceptibility of changes. This method requires at least 30 participants to achieve statistical significance and works best for fine-tuning existing formulas rather than developing entirely new products.

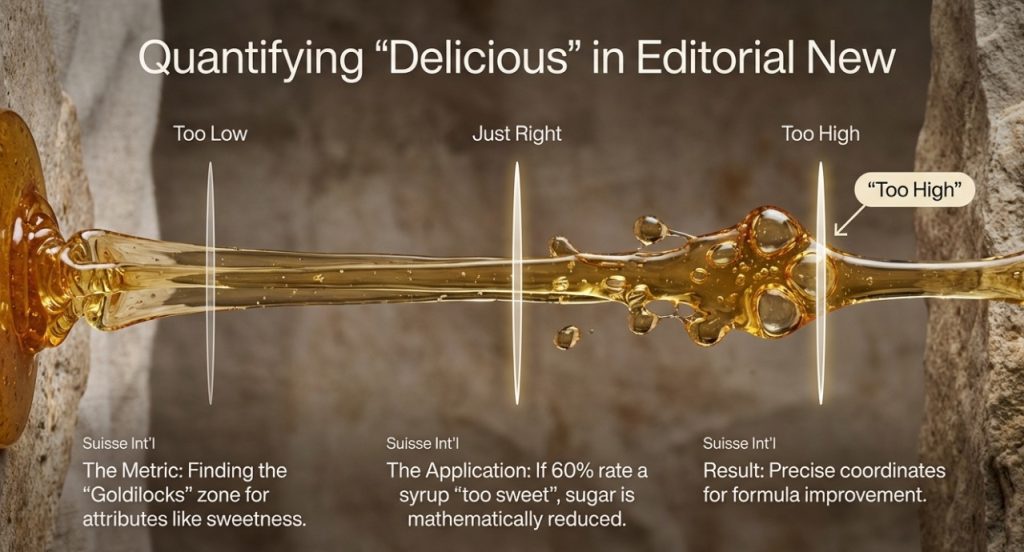

Descriptive analysis involves trained sensory panels using standardized vocabulary to map flavor profiles, such as “caramel sweetness level 7” or “astringency level 3.” This method proves particularly effective when selecting coffee powders or tea leaves, establishing clear quality benchmarks. Consumer acceptance testing directly asks target customers about preference levels and purchase intent. These tests often employ “Just About Right” scales, allowing consumers to rate attributes like sweetness or concentration as “too high,” “too low,” or “just right.”

The combination of descriptive metrics and consumer preferences provides precise coordinates for improvement. If 60% of consumers rate a juice syrup as “too sweet,” manufacturers can reduce sugar content and retest until satisfaction levels meet targets. The three methods work together to form a complete sensory evaluation framework.

Digital Tools Accelerate Feedback Collection

Mobile apps and online ordering systems provide real-time feedback channels, dramatically reducing data collection cycles. After customers order through apps, systems can push brief surveys within 24 hours of consumption, asking 3-5 core questions about “taste satisfaction” or “sweetness appropriateness,” typically achieving 15-25% completion rates. Compared to traditional paper surveys or manual interviews, digital methods reduce costs by 70% while improving sample representativeness.

Advanced systems integrate customer purchase history to analyze relationships between repurchase behavior and taste preferences. Customers who prefer brown sugar pearls may have higher sweetness tolerance, insights that guide operators toward differentiated product lines. Social media monitoring represents another underutilized data source. User-generated content on TikTok and Instagram provides unstructured feedback, revealing flavor characteristics consumers spontaneously discuss.

Natural language processing tools developed by MIT’s data science team can extract sentiment and keyword frequencies from reviews, identifying high-frequency complaints like “too sweet” or “not concentrated enough.” This qualitative data supplements quantitative surveys, capturing unmet needs in consumers’ authentic contexts. Combining digital surveys, behavioral tracking, and social listening, operators build multidimensional feedback networks for comprehensive market intelligence.

Converting Feedback Data Into Formula Adjustments

The first step in data analysis identifies trends rather than individual opinions. When 70%+ of consumers point to the same issue, such as excessive sweetness in taro powder, this signals a clear improvement opportunity. Analysts use regression models to evaluate how attribute changes impact overall satisfaction, determining adjustment priorities. If data shows sweetness has an impact coefficient of 0.6 and texture 0.3, operators should prioritize sugar reduction over texture modification.

After formula modifications, validation testing confirms changes achieve intended effects. A/B testing commonly assigns new and old formulas randomly to different customer groups, comparing satisfaction differences. If the new formula wins in blind testing with statistical significance at p<0.05, the improvement is confirmed successful. This cycle may repeat 3-5 times to reach optimization. For example, when Yenchuan developed a new juice syrup, four testing rounds improved initial acceptance from 62% to 89%, with each adjustment based on precise analysis of previous feedback data.

Continuous validation ensures improvement directions remain correct, avoiding misinterpretation of market needs. The iterative process balances speed with accuracy, moving quickly enough to maintain relevance while thorough enough to ensure quality. This disciplined approach transforms raw feedback into actionable formula improvements.

How AI Technology Predicts Flavor Trends

Artificial intelligence elevates feedback loops to predictive levels. Machine learning algorithms analyze thousands of data points linking chemical compositions, sensory descriptors, and consumer ratings to build flavor acceptance prediction models. IBM’s Chef Watson system suggests innovative pairings based on molecular structures, like watermelon with basil. These tools reduce new product development risk by simulating market reactions before actual production.

For bubble tea, AI analysis can predict acceptance distributions for combinations like “lychee with jasmine green tea,” identifying high-potential formulas. Predictive analytics also applies to trend forecasting. The Gastrograph AI platform tracks social media, sales data, and climate changes to predict flavor preference shifts 6-12 months ahead. Systems might predict rising low-sugar demand, guiding operators to develop sugar alternative syrup product lines preemptively.

This forward-looking strategy lets suppliers position themselves before market trends solidify rather than reactively following competitors. However, AI predictions need integration with human professional judgment. Technology cannot fully replace sensory experts’ understanding of cultural contexts and emotional connections. The optimal approach combines AI data analysis with human expertise, with the former providing efficiency and the latter ensuring quality.

Five Key Steps for Effective Feedback Loops

First, define clear measurement metrics. “Delicious” is subjective and needs decomposition into quantifiable dimensions like sweetness, concentration, aftertaste, and overall preference, rated on 1-9 Likert scales. Standardized metrics ensure data collected at different time points remains comparable. Second, establish representative samples. Target audiences span multiple demographic segments, and single-location feedback may be biased. Operators need data collection across different locations and times to ensure samples reflect true market structure. A minimum of 100-200 valid surveys provides statistical meaning.

Third, rapid iteration testing. Feedback loops derive value from speed; the cycle from data collection to formula adjustment should not exceed 2-3 weeks. Delayed responses reduce data timeliness as consumer preferences may have shifted. Fourth, build cross-functional teams. Product development, data analysis, marketing, and procurement departments need collaborative coordination to ensure feedback translates into executable actions. Isolated R&D departments struggle to grasp market dynamics.

Fifth, continuous monitoring rather than one-time surveys. Feedback loops are ongoing processes, not one-off projects. Seasonal changes, competitive dynamics, and consumer expectations continuously evolve. Establishing normalized data collection mechanisms and quarterly reviews of key metric trends maintains product competitiveness over time.

Taiwan’s Bubble Tea Industry Feedback Practices

Taiwan, as the birthplace of bubble tea and the world’s largest ingredient supply source, leads in applying consumer feedback systems for product optimization. According to Allied Market Research, Taiwanese brands entering North American markets used localization testing to improve formula acceptance from initial 55% to 82%. Adjustments included reducing sweetness to align with health consciousness trends, adding plant-based milk options for vegan needs, and developing instant pearls to reduce wait times.

Each improvement stemmed from systematic analysis of hundreds of consumer feedback responses. Taiwan suppliers’ advantage lies in vertical integration capabilities. From tea leaf cultivation and pearl manufacturing to packaging materials, complete supply chains support rapid formula iteration. When feedback data indicates improvement needs, suppliers can complete test batch production within 2 weeks, reducing timelines by 60% compared to cross-border sourcing models. This agility lets Taiwan brands maintain innovation leadership, continuously defining global bubble tea standards.

References

- Cornell University Food Science Department – Sensory science and consumer research

- UC Davis Sensory Science Center – Food sensory evaluation methods

- USDA Food Composition Databases – Nutritional composition and formulation standards

- Allied Market Research – Global bubble tea market analysis

- ISO 22000 Food Safety Management – Food safety management systems

Frequently Asked Questions

Discrimination testing requires a minimum of 30 participants to achieve statistical significance. Consumer acceptance testing benefits from 100-200 valid surveys. Samples should represent target market demographics including age groups, genders, and consumption frequencies. Single-location feedback may be biased; collecting data across 3-5 locations ensures representativeness.

Conduct comprehensive surveys quarterly to capture seasonal preference changes. New products need intensive monitoring for the first 3 months, collecting data every 2-3 weeks for rapid iteration. Mature products can reduce frequency to semi-annually but still require continuous satisfaction trend tracking and competitive monitoring.

When opinions diverge, analyze demographic characteristics to identify preference differences. For example, 18-25 year-olds may prefer higher sweetness while those 30+ lean toward lower sugar. Operators can develop different sweetness options for diverse needs. Without clear segmentation patterns, follow majority opinion principles—only 70%+ consistent feedback warrants adjustments.

AI provides trend forecasting and formula optimization suggestions but cannot fully replace sensory experts. Technology analyzes molecular structures and chemical components yet struggles to capture cultural contexts, emotional connections, and cross-sensory experiences. Best practice combines AI data analysis with human professional judgment, the former providing efficiency and the latter ensuring quality.

Start with simple digital tools like Google Forms or social media polls. Encourage customers to scan QR codes for 3-5 question surveys, offering discount incentives to improve completion rates. After accumulating 50-100 responses, analyze common patterns and prioritize addressing high-frequency complaints. Invest in professional systems as the business grows.

Author: Michael Zhang

As an observer of the food technology industry, I believe consumer feedback loops serve not merely as quality management tools but as bridges building trust between brands and customers. When companies demonstrate a commitment to “listening and improving,” consumers offer more authentic feedback, creating virtuous cycles. Taiwan’s global bubble tea success stems from this keen responsiveness to consumer needs. Future intelligent feedback systems integrating AI prediction, IoT monitoring, and blockchain traceability will further solidify Taiwan’s position as a bubble tea innovation hub. Yet technology ultimately serves people. Only by maintaining reverence for taste experiences and commitment to cultural heritage can we create classic flavors that withstand the test of time.

For insights into building systematic product development processes or exploring customization services meeting international market needs, contact Yenchuan to discuss solutions tailored to your business.