The protein sourcing decision centers on three critical factors: nutritional completeness, cost-performance ratio, and supply chain reliability. Whey protein isolate delivers a complete amino acid profile with 2.7 grams of leucine and 43% essential amino acid content per 25-gram serving, optimized for rapid absorption and muscle protein synthesis. Plant-based alternatives require strategic blending of pea, rice, and soy sources to achieve nutritional parity, typically offering 21-37% essential amino acid content with lower allergen risk and superior sustainability credentials. Procurement teams must evaluate target market requirements, product positioning, and certification standards, as both protein types can meet sports nutrition and functional food specifications when properly formulated.

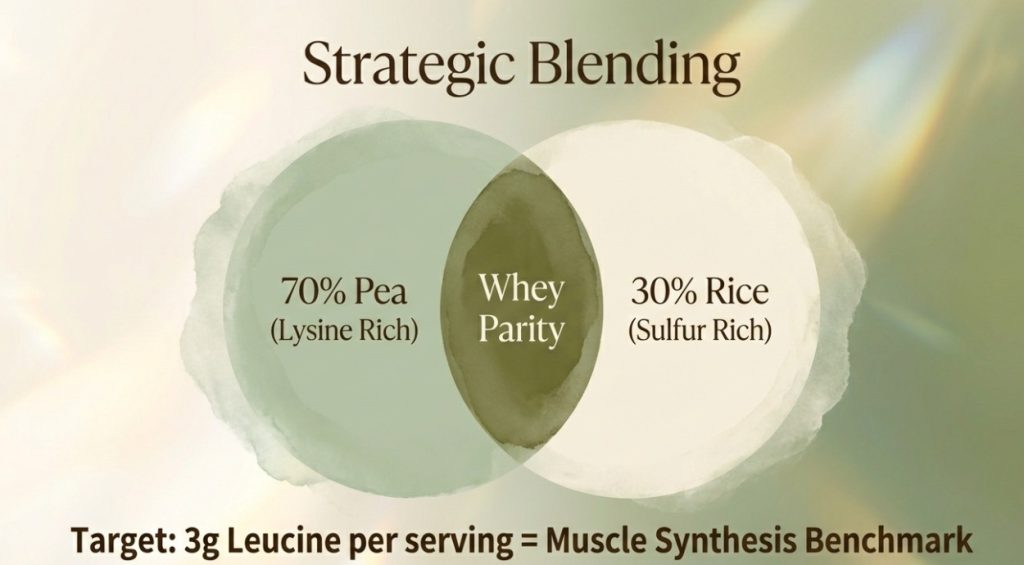

A 2018 study published in Nutrients found that pea-rice protein combinations matched whey protein’s nutritional value when leucine content reached 3 grams per serving. Cornell University’s food science department emphasizes that protein source selection should account for digestibility scores, solubility characteristics, and flavor stability — factors directly impacting consumer acceptance and market competitiveness.

Nutritional Profile Analysis: Essential Amino Acid and BCAA Content

Protein quality assessment hinges on essential amino acid composition and branched-chain amino acid ratios. Whey protein isolate contains 43% essential amino acids, with BCAAs — leucine, isoleucine, and valine — comprising 26% of total protein content. Leucine alone represents approximately 10% of whey’s amino acid profile. Single-source plant proteins show lower essential amino acid content: oat at 21%, wheat at 22%, pea at 30%, and corn at 32%. The critical disparity lies in specific amino acid abundance — whey protein delivers 2.5% methionine and 7% lysine, while plant proteins average 1% and 3.6% respectively.

Research published in Frontiers in Nutrition (2021) demonstrates that precision blending achieves amino acid profiles comparable to whey protein. Pea protein provides abundant lysine but lacks sulfur-containing amino acids, while rice protein offers the inverse profile. A 7:3 pea-to-rice ratio effectively complements these deficiencies. Corn protein, with 13.5% leucine content, serves as an effective leucine fortification ingredient. Potato and winged bean proteins supply rich BCAA content, while persimmon and lima bean proteins contribute histidine. Formulation design must align with target demographic needs — elderly nutrition products require minimum 3 grams leucine per serving, while sports nutrition demands total BCAA content exceeding 5 grams.

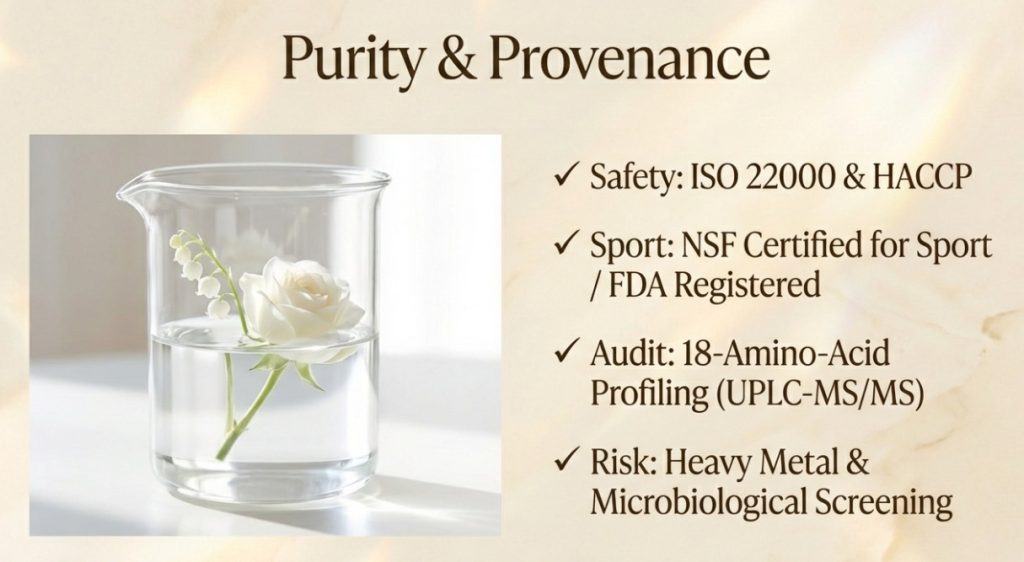

In procurement practice, supplier amino acid analysis reports must include comprehensive 18-amino-acid profiles rather than aggregate essential amino acid totals. Testing methods should employ UPLC-MS/MS or high-performance liquid chromatography to ensure data traceability. Protein content declarations must calculate on a dry-weight basis to prevent moisture content from distorting comparative benchmarks. For products claiming high leucine content, verify whether fortification derives from natural protein sources or added amino acids, as the latter triggers food additive regulatory requirements.

Supplier Certification and Quality Management System Evaluation

B2B protein procurement risk management begins with rigorous supplier certification vetting. ISO 22000 food safety management systems represent the baseline threshold, integrating HACCP hazard analysis with ISO 9001 quality management principles to ensure full traceability from raw material to finished product. FSSC 22000 builds upon this foundation by adding food fraud mitigation, allergen control protocols, and internal audit requirements — standard procurement criteria for most multinational retail chains. GMP certification focuses on production environment and personnel training, complemented by third-party laboratory batch testing reports verifying protein concentration, heavy metal content, and microbial limits against regulatory standards.

For U.S. market access, confirm supplier FDA registration and NSF Certified for Sport certification, the latter screening for banned substances in sports nutrition products. European Union markets require EFSA compliance, with organic products additionally needing EU Organic Certification. Halal and kosher certifications apply to specific regional markets based on target consumer demographics. Certificate validity must be cross-referenced through issuing body websites rather than relying solely on supplier-provided documentation, as counterfeit certification represents a documented risk in certain regions.

Audit procedures should encompass documentary review and on-site inspection phases. Documentary requirements include recent three-batch test reports (Certificates of Analysis) covering protein content, amino acid composition, heavy metals (lead, cadmium, mercury), microbiological testing (E. coli, salmonella), and allergen screening results. On-site inspection priorities include production area zoning design, cross-contamination prevention measures, raw material storage temperature and humidity controls, and personnel hygiene training records. For allergen-free claims, verify whether production lines share facilities with allergenic products and whether cleaning validation procedures meet regulatory requirements. Suppliers holding GFSI-recognized certification schemes demonstrate international-standard quality management, streamlining procurement evaluation timelines.

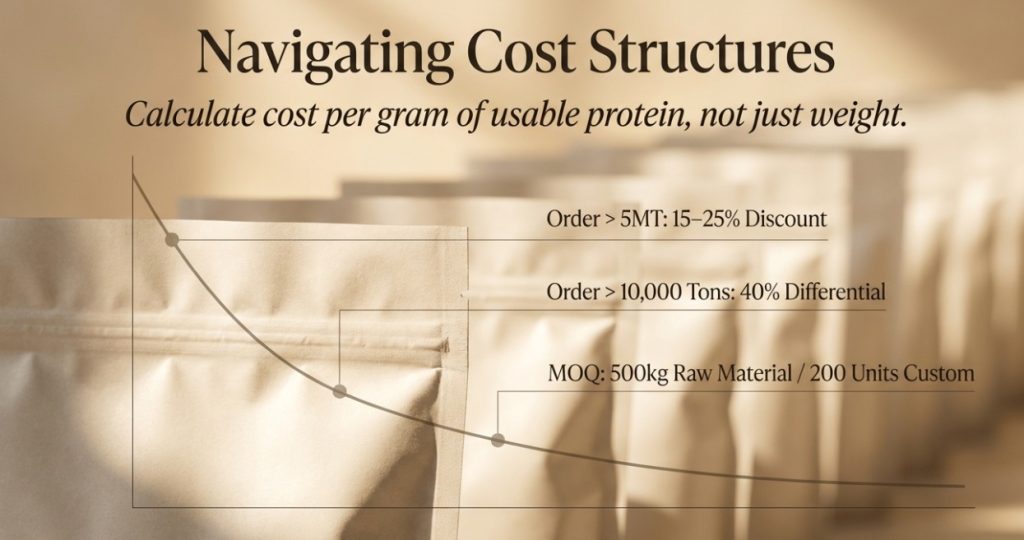

Minimum Order Quantities and Customization Options Impact on Total Cost

Protein powder procurement economies of scale directly manifest in MOQ structures. Bulk raw material powders typically require 500-2,000 kilogram minimum orders, while custom-packaged finished products may start at 200 units. However, unit costs decrease inversely with order volume — orders exceeding 5 metric tons typically secure 15-25% discounts, with 10,000-ton contracts achieving 40% price differentials. Cost structures must encompass raw materials, processing, packaging, logistics, and tariffs, calculated per gram of usable protein rather than simple weight comparisons to avoid hidden costs from low-concentration products.

Customization services impact total cost primarily through development phase investments. Flavor adjustment requires 2-4 week development periods involving masking agent and sweetener ratio testing, with single-phase development fees ranging $1,500-3,000. Texture improvement through micronization or enzymatic hydrolysis enhances solubility, adding 8-12% processing costs while significantly improving consumer experience. Fortification formulas incorporating vitamins, minerals, or probiotics require compatibility verification and shelf-life validation. Multi-ingredient products warrant accelerated stability testing to prevent post-launch precipitation or flavor degradation.

Packaging options span PE zipper pouches, aluminum foil composite films, to rigid plastic containers, with unit cost variations reaching 3-8 fold differentials. However, high-barrier packaging extends shelf life 6-12 months, reducing inventory turnover pressure. Label design must comply with target market regulations — U.S. markets require FDA-format nutrition labeling, while EU markets follow Regulation (EU) No 1169/2011 allergen disclosure requirements. For startup brands, initial adoption of supplier standard packaging minimizes upfront investment, transitioning to custom development after market validation. Long-term partnerships enable negotiation of consignment inventory or VMI (Vendor Managed Inventory) models, transferring capital pressure to supply chain partners.

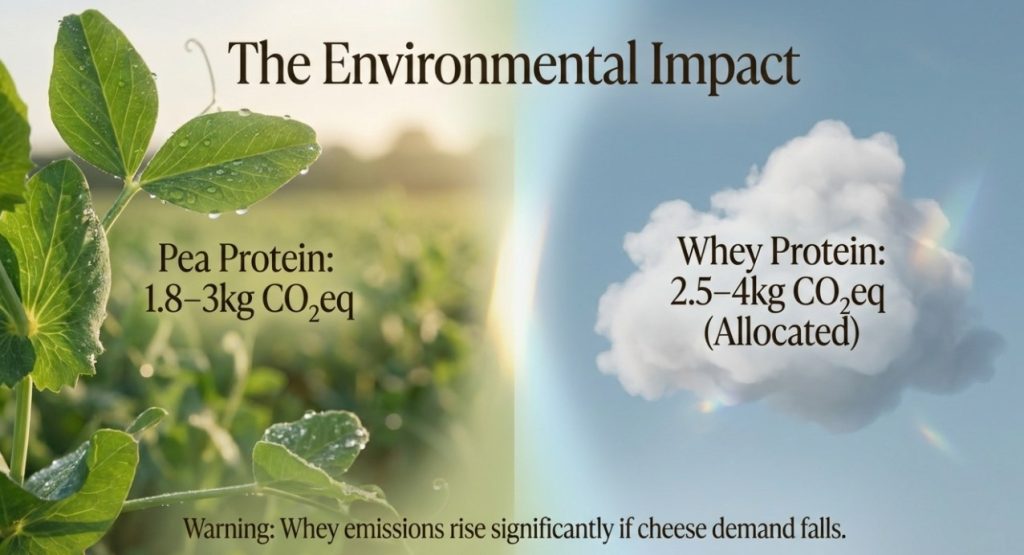

Environmental Sustainability: Carbon Footprint Comparison Between Whey and Plant Proteins

Protein source environmental impact assessment requires life cycle analysis methodology encompassing raw material production, manufacturing processing, transportation distribution, and waste disposal phases. A 2019 Arizona State University study reveals that whey protein, as a cheese production byproduct, demonstrates lower greenhouse gas emissions than most plant proteins when calculated through allocation methods. The critical distinction lies in environmental cost attribution logic — whey production’s primary driver is cheese demand, therefore carbon emissions should primarily attribute to the principal product rather than the byproduct. Per kilogram whey protein isolate generates approximately 2.5-4 kg CO₂ equivalent, compared to pea protein at 1.8-3 kg and soy protein at 2-3.5 kg.

However, this advantage presumes whey supply remains constrained by cheese production volumes. Global whey protein demand grows 10% annually; if growth rates continue exceeding cheese market expansion, or if cheese consumption declines due to plant-based alternative proliferation, whey transitions from byproduct to primary output. This shift would dramatically increase its allocated carbon emissions. Environmental nutrition experts at Loma Linda University note that this balance may break within the next 10-15 years, at which point plant protein sustainability advantages become more pronounced. Regarding water resource utilization, leguminous crops like pea and barley require approximately 1,200-2,000 liters per kilogram of protein, substantially below dairy’s 4,000-6,000 liters.

Enterprise procurement decisions must consider brand sustainability commitments and consumer expectations. Sustainability labels significantly influence purchasing decisions in European and North American markets, with carbon-neutral certification and regenerative agriculture sourcing creating 15-20% premium pricing opportunities. On the supplier side, certain whey manufacturers reduce processing carbon emissions through biogas generation and wastewater recycling initiatives. Upcycled barley proteins developed from brewing byproducts exemplify zero-waste circular economy practices. Procurement specifications should request supplier EPD (Environmental Product Declaration) or LCA assessment reports to verify quantified emission reduction measures and avoid greenwashing marketing. Long-term, plant proteins demonstrate lower vulnerability to climate change and raw material price volatility, offering stronger supply chain resilience suitable for diversified procurement strategies.

Formulation Design Considerations for Sports Nutrition and Functional Food Applications

Protein application context determines formulation design direction. Sports nutrition products prioritize rapid absorption and muscle synthesis efficiency. Whey protein isolate achieves digestion absorption rates exceeding 95%, reaching peak blood amino acid concentrations 30-60 minutes post-consumption. Optimized plant protein blends achieve 90-93% digestibility but demonstrate slightly slower absorption rates, suitable for all-day protein supplementation or sustained-release pre-sleep formulas. A 2020 Journal of Sports Nutrition study found pea-rice protein combinations with leucine fortification produced muscle protein synthesis responses comparable to whey protein, provided leucine content reached 3 grams per serving.

Functional food applications require balancing nutritional value with sensory quality. Whey protein inherently carries dairy flavor profiles, fitting shake, yogurt, and baking applications, though lactose-intolerant demographics require highly hydrolyzed or isolate specifications. Plant protein’s beany notes and powdery mouthfeel present primary challenges. Pea protein significantly improves through air classification and enzymatic processing. Brown rice protein’s mild flavor suits light-tasting products. Hemp seed protein, rich in omega-3 and fiber, targets health-conscious markets but requires strict THC content regulatory compliance.

Texture adjustment involves protein solubility and emulsification performance. Whey protein demonstrates minimum solubility at pH 4.5-5.5; acidic beverages require formula adjustment or emulsifier addition. Plant proteins show wider isoelectric point ranges, with rice and pea proteins performing better at neutral pH. Cold-soluble products require instantized granules or microencapsulated proteins; hot beverage applications must verify thermal stability to prevent coagulation. Sweetener pairing influences overall flavor balance — erythritol and stevia suit low-calorie positioning, while lactose or maltodextrin provides rounded mouthfeel. Prototyping phases should conduct consumer blind testing, confirming target demographic acceptance rates reach 70% before advancing to mass production.

Authoritative Sources

- Cornell University – Food Science

- Nutrients Journal – PMC

- Arizona State University – Environmental Research

- Frontiers in Nutrition

- USDA Agricultural Research Service

- International Dairy Journal

Frequently Asked Questions

Bulk raw material pricing positions WPC80 whey concentrate at $8-12 per kilogram, with WPI90 isolate at $12-18. Pea protein isolate ranges $7-11, brown rice protein $6-9, and soy isolate $5-8. Pricing fluctuates based on source origin, processing grade, and market supply-demand dynamics. Recent legume crop shortfalls drove pea protein prices up 30% year-over-year.

Request third-party laboratory test reports using Kjeldahl nitrogen analysis or UPLC-MS/MS amino acid profiling to confirm protein content and amino acid composition data. Submit batch samples to independent facilities like SGS or Eurofins for verification testing against supplier reports. Validate laboratory ISO/IEC 17025 accreditation to ensure testing methodology meets international standards.

Soy and wheat represent major allergens requiring regulatory labeling. Pea, rice, and hemp seed allergies are rare but cross-contamination requires monitoring. Production lines sharing facilities with nuts or sesame must execute cleaning validation protocols and include “may contain” precautionary labeling. Halal and vegan certifications require verification of raw material sources and processing aids to prevent animal-derived contamination.

Choose whey isolate for maximum rapid absorption and highest leucine content, optimizing 30-minute post-workout consumption. Plant protein combinations suit vegetarian, lactose-intolerant, or environmentally-conscious demographics, requiring formulas with minimum 3 grams leucine per serving. Both protein types produce equivalent long-term muscle growth outcomes when total protein intake proves adequate and resistance training accompanies supplementation.

Verify company revenue data, production line scale, and customer reorder rates — annual revenues exceeding $5 million with 30%+ reorder rates indicate higher stability. Confirm diversified raw material sourcing strategies avoiding single supply chain vulnerabilities. Request capacity utilization data ensuring production flexibility accommodates order growth. Recommend facility site visits or virtual audits evaluating equipment maintenance standards and personnel expertise levels.

Author: Michael Zhang

As a food supply chain consultant, I observe protein procurement decisions shifting from cost-driven to value-driven frameworks. Simple per-kilogram price comparisons insufficiently reflect true costs — formula stability, consumer acceptance, regulatory risk, and sustainability credentials all constitute critical variables influencing product success. Enterprises should establish diversified supplier portfolios, allocating proportions between whey and plant proteins while flexibly adjusting based on market trends and raw material price volatility. Simultaneously invest in long-term supplier partnerships to co-develop customized solutions rather than focusing solely on short-term procurement costs, thereby building differentiated advantages in the competitive protein market landscape.

Ready to explore protein ingredient sourcing strategies or functional food development services? Schedule a consultation with Yenchuan’s team to discuss solutions tailored to your enterprise requirements.